Business Finances

Business Finances

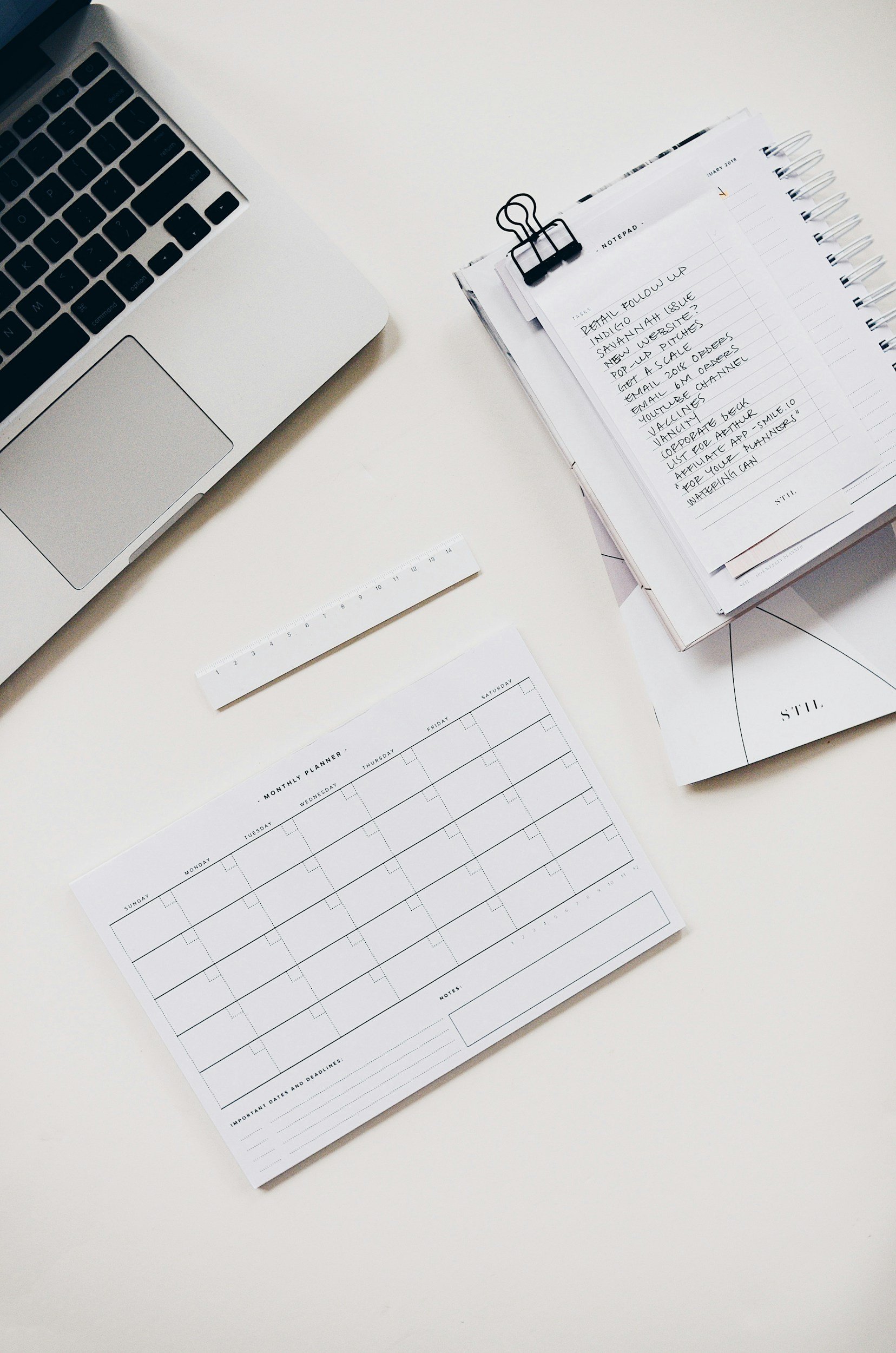

Master Your Money, Grow with Intention.

The Business Finances column empowers female founders to take control of their cash flow, pricing, profitability, and tax strategy. From budgeting and forecasting to smart investing and financial systems, we break down what it takes to build a business that funds your freedom—without the overwhelm.

✨ Ready to grow?

→ [Download the FemFounder PR Starter Kit — Free]

→ [Work with our in-house PR agency, Marquet Media]

→ [Explore templates, tools, and training in the shop]

Why Financial Literacy is the Key to Business Success (and How the Dream It, Earn It Planner Can Help)

Running a business is about more than having a great product or service. To thrive, you should have a deep understanding of your finances. Financial literacy is the backbone of every successful business, empowering entrepreneurs to make informed decisions, manage risks, and maximize growth opportunities.

12 Financial Planning Tips for Emergencies

Financial emergencies are, most of the time, unexpected and undesirable. In the blink of an eye, you could lose your job, pay high medical bills, or need to repair your car or even your home urgently.

Although it's never fun to think about these possibilities, you have to do your best to be ready to handle any emergency. But how can you prepare to face an event you can't predict? Following these financial planning tips for emergencies is a good place to start.

Capital Innovation for Insurance: Focus on Mid-Market Players

Capital solutions are the linchpin of financial sustainability for mid-market insurers. These solutions enable companies to meet regulatory requirements and provide the necessary support for managing risks and driving growth. Capital financial services can help insurers navigate the complexities of capital management.