The Financial Hack That Will Change Your Saving Game Forever

/In the world of personal finance, people are seeking better ways to save money. The combination of inflation and increasing living costs has led many to open savings accounts.

Read MoreIn the world of personal finance, people are seeking better ways to save money. The combination of inflation and increasing living costs has led many to open savings accounts.

Read MoreMaking impactful changes in a company doesn’t always require deep pockets or lavish spending. The common misconception that significant investments are the only path to meaningful change can deter many from pursuing initiatives, especially ones that could transform their operations, culture, or market standing. Yet, the reality is far more encouraging. The business development landscape is rich with opportunities for impactful change that do not require substantial financial outlay.

Read MoreAnybody can achieve financial freedom, but it takes planning and determination to make it happen. Some people think that it’s a nice theory but could never happen for them. However, this sort of mindset is the exact thing holding you back. Read on and you’ll find out how you can work towards financial freedom in 2020:

What Is Financial Freedom?

First, let’s get to grips with what financial freedom really is. Financial freedom is the act of taking ownership of your finances. It allows you to live the life you want and means you don’t have to worry about how to pay your bills or even any sudden expenses you may need to deal with. It also means you don’t have debts to pay off.

Where Are You Now?

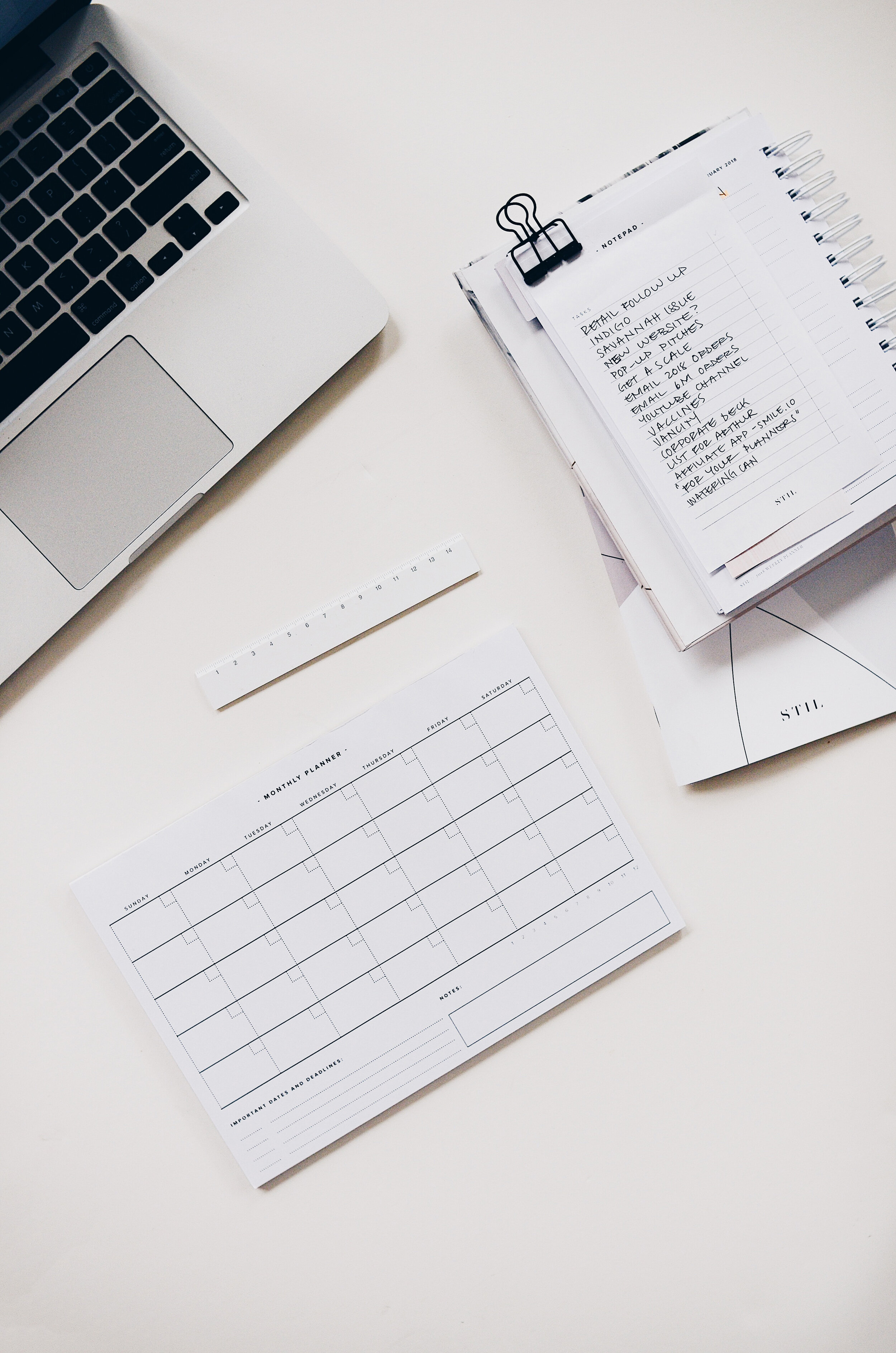

Understanding where you are now is important if you want to move forward and make changes. Start by compiling a list of things like your debts, credit cards, and anything costing you money. Add up all of the numbers.

Once you’ve done this, compile a list of all of your savings. Include any stocks you may have, retirement plans, etc. You can then work out the money you have coming in from your regular job, side hustle, and so on. Write these numbers down and keep them in mind as you look at the rest of the tips.

Write Down Your Goals

If you don’t really know what you’re working towards, you can hardly expect to make changes. Financial freedom doesn’t happen by accident. Emotional goals will always get the best results. So, do you want to get married? Buy a house? You need things that appeal to you on an emotional level, or you are unlikely to stick to it. You’ll feel so much better about your debts decreasing and your savings increasing when you know exactly what you’re saving for.

Change The Way You Think/Talk About Money

The way you think and talk about money is largely down to your money mindset. Everybody has a money mindset, and for most people, it’s negative. Mindsets can be passed down through generations, so it’s important to become aware of yours and then overcome it if you need to. Reading books, listening to podcasts, and watching YouTube videos can all help you change your mindset. You can’t become financially free while viewing money as a negative or unpleasant thing. You might even decide now is the right time to get expert legal assistance from a qualified maritime accident attorney if you’ve put it off. Ask yourself why you put off claiming money that is rightfully yours. Chances are, it was down to your money mindset.

Track Everything You Spend

Track every single thing you spend money on so you can understand yourself better. You can then come up with a financial plan so you can put money towards your goals while still treating yourself to a little of what you like.

Passive Income Ideas

Finally, explore passive income ideas. Side hustles and passive income is likely how you will build your wealth over the long term. It’s pretty hard to build wealth when you’re swapping all of your time for money at a 9-5 job!

Get The Compensation You’re Owed

There are many reasons why you might be owed compensation from somebody. One of the most common situations is a road traffic accident that wasn’t your fault. These can be minor incidents or major situations that involve the courts, but if you are affected by this then you will be entitled to compensation from the third-party insurance company. It’s important to know your rights in a situation such as this and to get what you’re owed. The extra money can go towards a savings fund to support your financial freedom in the future. Hiring a personal injury lawyer is one way to ensure that you get the payout you deserve. Don’t forget, there will have been a lot of stress and unforeseen administration on your part too, that should be taken into account.

Don’t Forget To Save

When thinking about financial freedom most people immediately think about earning more money. Of course, this makes sense, but there is literally no point in earning extra income if your present financial situation is inefficient. The old phrase ‘a penny saved is a penny earned comes to mind.’ Any decent financial advisor will tell you that before you think about saving your need to first pay off any debts you owe. It is counter-productive to try to save and pay-off debts at the same time, so if you are earning extra, make sure that you channel it into your debts first before stock-piling your savings account–it is the fastest way to financial freedom.

FemFounder is a one-stop shop for creative entrepreneurs and small business owners who need PR, Instagram, Pinterest, and email list building help.