Your Story

Your Story

Your Story Matters Here

Because the most powerful brand you’ll ever build is the one rooted in truth.

At FemFounder, we believe every woman’s entrepreneurial journey deserves to be seen, heard, and celebrated. Your story isn’t just personal—it’s part of a collective movement shaping what leadership, success, and visibility look like today. Whether you’re scaling a brand, launching your first product, or redefining your path entirely, your experiences hold power.

We’re here to tell them—with integrity, beauty, and the strategy they deserve.

✨ Ready to grow?

→ [Download the FemFounder PR Starter Kit — Free]

→ [Work with our in-house PR agency, Marquet Media]

→ [Explore templates, tools, and training in the shop]

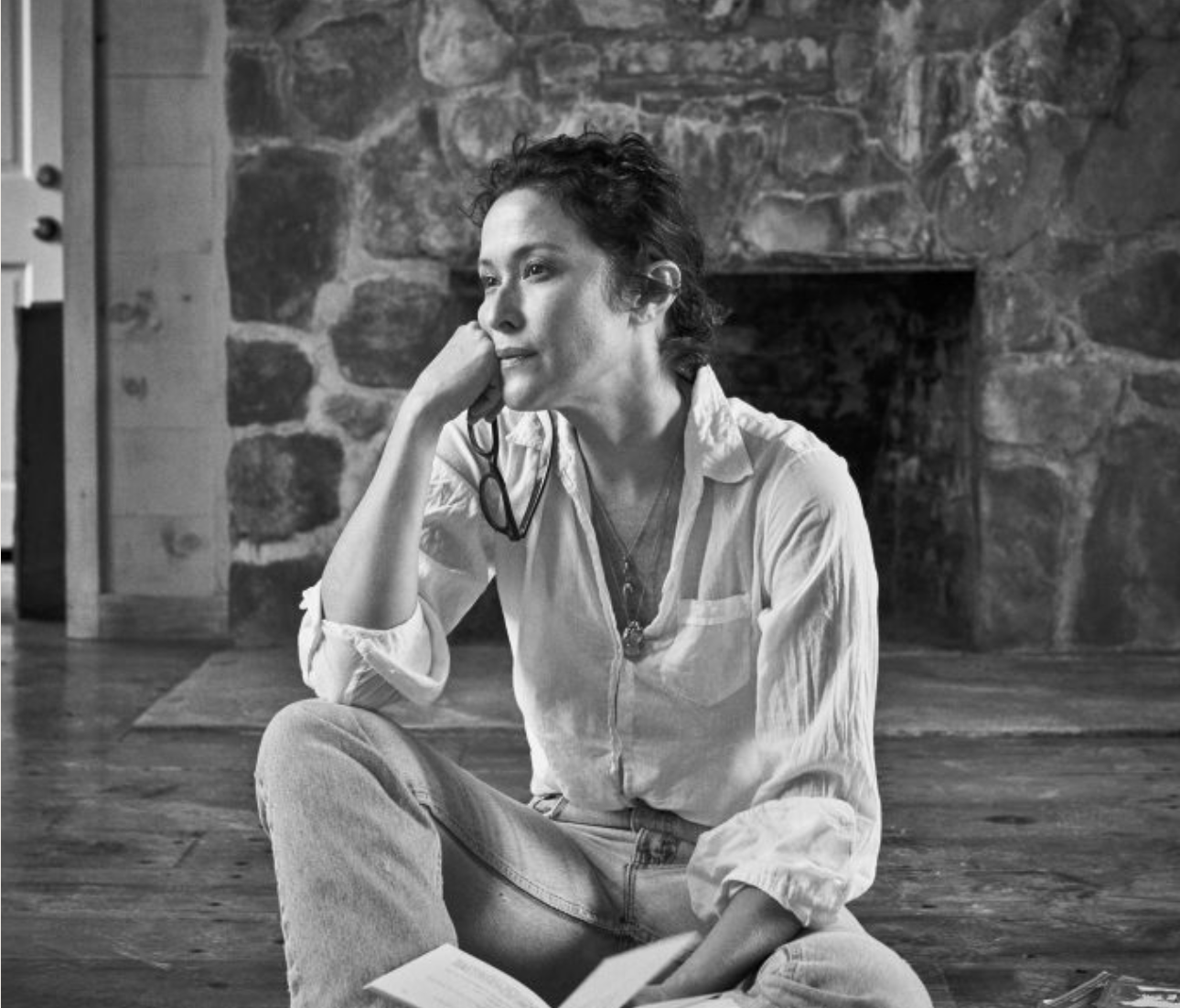

Stay Passionate and Persistent with Natane Boudreau

Natane Boudreau is the Founder and Interior Designer at Studio Boudreau, a design firm known for creating beautiful and functional spaces that reflect clients' unique styles. With over a decade of experience, Natane has transformed numerous homes and commercial properties through innovative design solutions.

"Look at your business plan now because things change" with Christine Blanchette

Christine Blanchette is a nationally published health and fitness/lifestyle writer. She writes a weekly column in Quebec’s second largest English language newspaper, The Sherbrooke Record, and freelances for other notable publications. In addition, Christine is the creator, producer, and host of Run With It, which is Canada’s only running, fitness and health show, airing on Novus (TELUS) TV and YouTube channel. Christine’s other show on Novus (TELUS) TV and YouTube channel is The Closing Act, which profiles musicians, and other movers and shakers in the entertainment industry.