Innovative Investment Options for Small Business Owners Beyond Traditional Stocks and Bonds

While stocks and bonds are common investment choices, small business owners can explore various other avenues to diversify their portfolios and enhance their revenue streams. This article will introduce some innovative investment options that go beyond the traditional choices. By understanding these alternatives, small business owners can strategically allocate their resources, manage risk, and maximize returns.

Investing in Private Equity

Private equity involves investing resources into private companies or buyouts of public companies, resulting in their delisting from public stock exchanges. This form of investment is typically less liquid than public stocks but offers the potential for substantial returns.

Small business owners can engage in private equity by joining private equity funds or directly investing in promising private companies. These investments often focus on improving the company's operations, management, and market position to enhance its value. While private equity requires a longer investment horizon and higher capital outlay, the potential returns can be significant.

Private equity investors can often play a dynamic role in the management and strategic operations of the company, providing opportunities to leverage business expertise and networks. This involvement can lead to a more profound understanding of the industry and better investment decisions.

Investing in Sustainable and Green Technologies

As global awareness of environmental issues increases, sustainable and green technologies are gaining traction. Investments in this sector not only contribute to environmental preservation but also offer financial benefits.

Green technologies include renewable energy sources like solar, wind, and hydroelectric power. Investing in companies that produce or support these technologies can yield substantial returns as the demand for clean energy grows. Small business owners can also invest in green bonds, which fund environmentally friendly projects and provide a stable income stream.

Energy-efficient technologies present another promising investment opportunity. Companies like Tesla and other EV manufacturers are at the forefront of this industry, and investing in their stocks can be profitable.

Benefits of Real Estate Syndication for Business Owners

Real estate syndication is an innovative investment strategy that allows small business owners to invest in large-scale real estate projects with minimal upfront costs. This method involves gathering resources with other investors to purchase and manage properties, thereby sharing the costs and risks associated with real estate investment.

One of the primary benefits of real estate syndication is the reduced financial burden on individual investors. By co-investing, small business owners can participate in valued real estate investment opportunities that would otherwise be out of reach. This collaborative approach also provides access to the expertise and experience of professional syndicators, enhancing the likelihood of successful investments.

Real estate syndication offers the potential for significant passive income. Rental income from the properties can provide a steady cash flow, and real estate appreciation over time can lead to substantial long-term gains. For small business owners looking for a lower upfront cost to invest in lucrative opportunities, real estate syndication is an excellent option.

Angel Investing and Venture Capital: High Risk, High Reward

Angel investing and venture capital are two investment strategies that involve funding early-stage startups in exchange for equity. These investments are typically high-risk but can offer substantial rewards if the startup succeeds.

Angel investors are usually individuals who provide capital to startups in their early stages. This investment can be a one-time injection of funds or ongoing financial support. Small business owners with a keen eye for unique opportunities and a willingness to take risks can benefit significantly from angel investing.

Venture capital involves investing through a venture capital firm that pools funds from multiple investors. These firms invest in small businesses and startups that show strong growth potential, often in the technology sector. While venture capital investments require a larger capital outlay and involve more risk, they offer the potential for exponential returns.

Both angel investing and venture capital can diversify a small business owner's investment portfolio and provide exposure to cutting-edge technologies and business models. However, it's necessary to understand the risks involved before committing to these investment strategies.

Art and Collectibles: A Unique Investment Opportunity

Investing in art and collectibles is a unique strategy that can yield significant returns while also providing personal enjoyment. This investment category includes fine art, antiques, rare coins, stamps, and vintage cars, among others.

The value of art and collectibles can appreciate significantly over time, making them a profitable investment. Additionally, these assets often have low correlation with traditional financial markets, providing diversification benefits. Small business owners with an interest in art and a keen eye for valuable items can explore this investment option.

Investing in art and collectibles requires in-depth knowledge and expertise of each of their respective niches. It's crucial to understand the market trends, the provenance of the items, and their potential for appreciation. Working with reputable dealers and auction houses can help navigate potential risks and make certain that the investment is sound.

Peer-to-Peer Lending for Steady Returns

Peer-to-peer (P2P) lending platforms facilitate direct connections between borrowers and investors, bypassing conventional financial institutions. Through this model, small business owners can provide loans to individuals or other businesses. In return, the lenders receive their principal amount along with interest, creating a consistent source of income.

P2P lending offers several advantages, including higher returns compared to traditional savings accounts and bonds. The platforms often provide tools for assessing the creditworthiness of borrowers, allowing investors to make informed decisions. Additionally, the investment amounts can be relatively small, making it accessible for small business owners with limited capital.

However, P2P lending carries some risks, such as the potential for borrower default. Diversifying across multiple loans and using platforms with robust risk assessment processes can help manage these risks. Popular P2P lending platforms include LendingClub, Prosper, and Funding Circle.

Crowdfunding Investments for Small Business Owners

Crowdfunding has emerged as a popular method for raising funds and offers unique investment opportunities for small business owners. Through crowdfunding platforms, investors can fund projects or businesses in exchange for equity, debt, or rewards.

Equity crowdfunding allows investors to purchase shares in a small business. This investment provides the potential for high returns if the business succeeds. Debt crowdfunding, on the other hand, involves lending money to businesses in exchange for interest payments, offering a predictable income stream.

Reward-based crowdfunding involves funding projects in exchange for non-monetary rewards, such as early access or exclusive merchandise. While this form of crowdfunding doesn't provide financial returns, it can be an exciting way to support innovative projects.

Crowdfunding platforms like Kickstarter, Indiegogo, and SeedInvest offer various investment opportunities for small business owners. It's essential to research the projects and understand the terms of the investment before committing your resources to these projects.

Other Small Business Investments

This form of investment is typically less liquid than public stocks but offers the potential for substantial returns. Additionally, qualified small business stock (QSBS) can provide significant tax advantages for investors who meet the eligibility criteria.

Exploring Exchange-Traded Funds (ETFs)

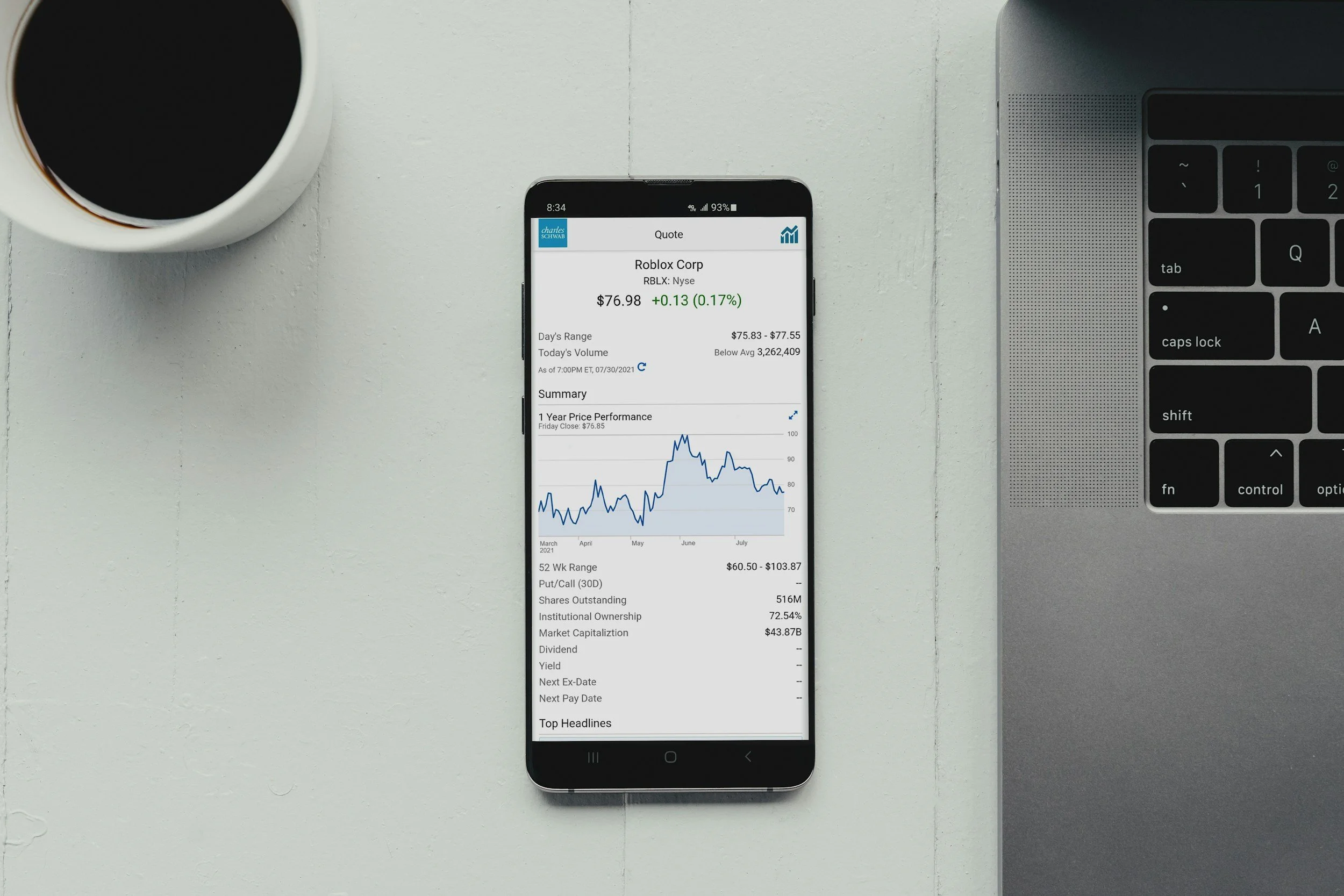

ETFs are a popular investment option for the reason that they offer diversification and liquidity. ETFs are funds that track a specific sector, commodity, or asset class and are traded on stock exchanges, much like individual stocks.

For small business owners, ETFs provide an easy way to diversify their investment portfolios. By investing in ETFs, they can gain insight to a vast spread of assets, such as stocks, bonds, real estate, and commodities, without the need to purchase each asset individually.

ETFs also offer the advantage of low management fees compared to mutual funds. They provide flexibility, as they can be purchased and sold throughout the trading day. Additionally, some ETFs focus on a specific sector, such as technology, healthcare, or renewable energy, allowing investors to target their investments based on their interests and market outlook.

Investing in Intellectual Property

Intellectual property (IP) investments involve purchasing rights to patents, trademarks, copyrights, or royalties. These assets can generate significant returns, especially if the underlying IP becomes widely used or commercially successful.

Small business owners can invest in IP by acquiring existing patents or trademarks, or by funding the development of new IP. This investment strategy can be particularly lucrative in industries such as technology, pharmaceuticals, and entertainment.

Investing in IP requires a thorough understanding of the legal and commercial aspects of the assets. It's essential to assess the potential market for the IP. Working with IP professionals and legal experts can help navigate potential risks and ensure a sound investment.

Leveraging Technology for Smarter Investment Decisions

Advancements in technology have made it easier for small business owners to make informed investment decisions. Financial technology (fintech) tools, such as robo-advisors, investment apps, and data analytics platforms, provide valuable insights and automated solutions for managing investments.

Robo-advisors generate algorithms that will create and manage investment portfolios based on an investor's goals. These platforms offer low-cost, hands-off investment management, making them an attractive option for small business owners with limited time and expertise.

Investment apps like Robinhood, Acorns, and Stash provide user-friendly functionality and access to a wide range of investment options. These apps often include educational resources and tools for tracking investment performance, helping users make informed decisions.

Data analytics platforms offer advanced tools for analyzing market trends, evaluating investment opportunities, and managing risk. By leveraging these technologies, small business owners can enhance their investment strategies and achieve better financial outcomes.

Expanding Your Financial Opportunities

Exploring innovative investment options beyond traditional stocks and bonds can give small business owners diverse opportunities to grow their wealth. These alternative investments offer unique benefits and potential returns, from private equity and sustainable technologies to real estate syndication and peer-to-peer lending. Small business owners can transform their financial stability and achieve long-term growth by understanding and strategically incorporating these options into their investment portfolios.