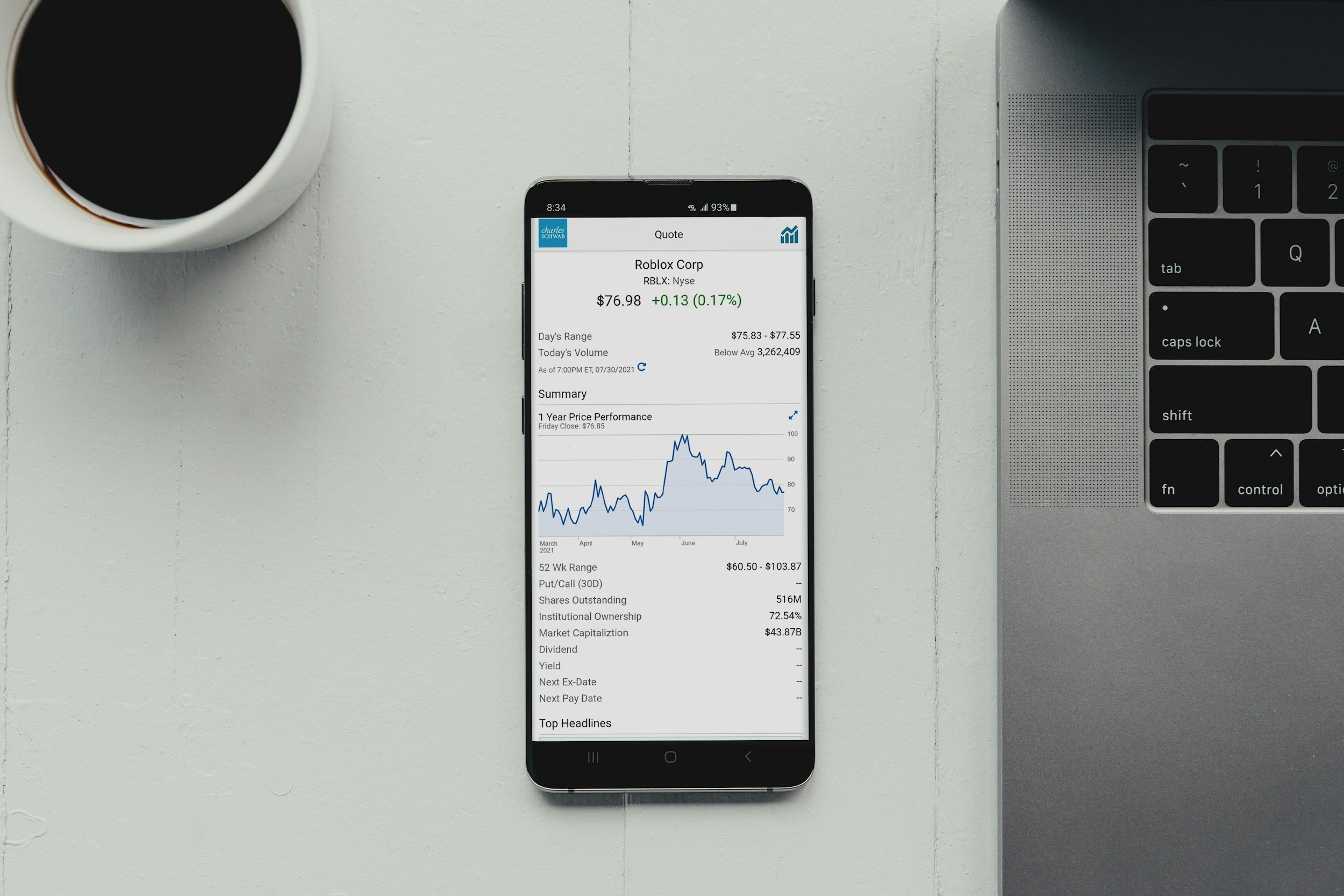

Innovative Investment Options for Small Business Owners Beyond Traditional Stocks and Bonds

While stocks and bonds are common investment choices, small business owners can explore various other avenues to diversify their portfolios and enhance their revenue streams. This article will introduce some innovative investment options that go beyond the traditional choices. By understanding these alternatives, small business owners can strategically allocate their resources, manage risk, and maximize returns.

Navigating the World of Real Estate Investment - How Wealth Development Company Can Help

Influential real estate investors know it is important to surround themselves with experts. This is especially true if they want to maximize their ROI.

Investing in property can be a great way to diversify your portfolio and build wealth over time. However, there is no one-size-fits-all solution. Choosing the right strategy requires careful planning and research.